“Inflation is much too high and we understand the hardship it is causing, and we’re moving expeditiously to bring it back down. We have both the tools we need and the resolve it will take to restore price stability on behalf of American families and businesses.” Thus did Jay Powell, chair of the Federal Reserve, open the press conference that followed the meeting of the Federal Open Market Committee last week. This was a grovelling apology. But it also sounded rather like Mario Draghi’s celebrated “whatever it takes” remark of July 2012.

What does the Fed’s renewed commitment to low inflation signify for the future? Powell argued optimistically that “we have a good chance to have a soft or softish landing”. By this he meant that demand would be brought closer to supply, which could in turn “get wages down, and get inflation down without having to slow the economy and have a recession and have unemployment rise materially”. He also argued that “the economy is strong, and is well positioned to handle tighter monetary policy . . . but I’ll say I do expect that this will be very challenging”.

The most puzzling thing about this line of argument is not the admission that the suggested path will be hard to achieve, but the belief that it will reach its destination. Is it even possible to lower inflation to target just by trimming overheating of the labour market?

Some suggest it might be. Alan Blinder of Princeton University and former Fed vice-chair has recently noted that on at least seven of the last 11 occasions, Fed tightening did lead to “pretty soft” landings. The difficulty with these comparisons is that inflation is now at its highest level for 40 years. Even “core” annual consumer price inflation (without energy and food) was 6.5 per cent in the year to March 2022.

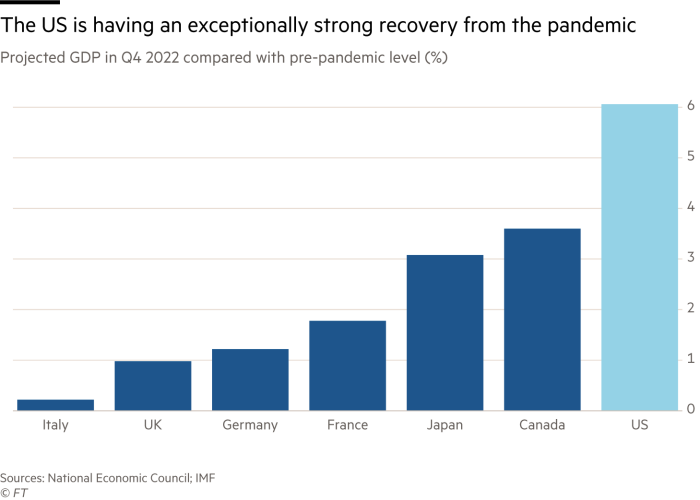

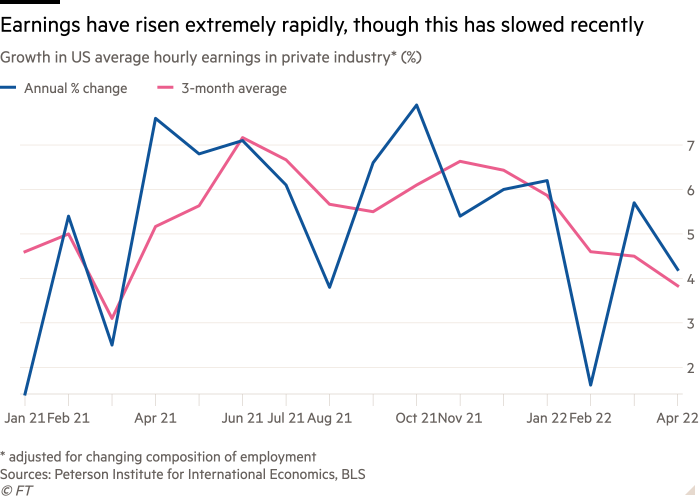

If one believes this will just fade away after a modest tightening, one must still think inflation is mostly “transitory”. That is highly optimistic. Crucially, the US has enjoyed an exceptionally vigorous recovery. Output growth last year was far stronger than in other leading high-income countries. The recovery of the labour market has been robust, with high vacancy and quit rates and a swift return to low unemployment. Only employment ratios remain a little below previous peaks. Moreover, wage growth has also been strong, as Jason Furman, former chair of the Council of Economic Advisers, notes, though it has been slowing a little.

The difficulty is that, contrary to Powell’s protestations, inflation does not usually just fade away in such a strong economy. Undoubtedly, a part of measured inflation is due to domestic and global supply constraints, discussed in detail in the Economic Report of the President last month. But this is also a way of saying that excess demand is now pressing on supply at home and abroad. If Powell is to prove correct, supply constraints must at least get no worse, while companies and workers adversely affected by them must take the reduced profits and real incomes on the chin. Yet why should they do so? As Furman notes: “The 8.5 per cent increase in the consumer price index in the 12 months through March is much faster than the pace of nominal wage growth, leading to the fastest declines in real wages over a year in at least 40 years.” Conditions for a cost-price spiral now exist. The hope must instead be that supply and labour market constraints reverse, generating falling prices and so eliminating almost all of the need to regain lost incomes.

This view that a significant recession will not be needed to curb inflation is optimistic. But this is not the only form of optimism on display today. The other is the belief that such a recession can be avoided. The difficulty here is that fine-tuning a slowdown will be even harder than it normally is. One uncertainty is that reduced real incomes from high inflation are likely to curb demand, but how far they will do so depends on how willingly consumers spend savings built up during the Covid-induced recession.

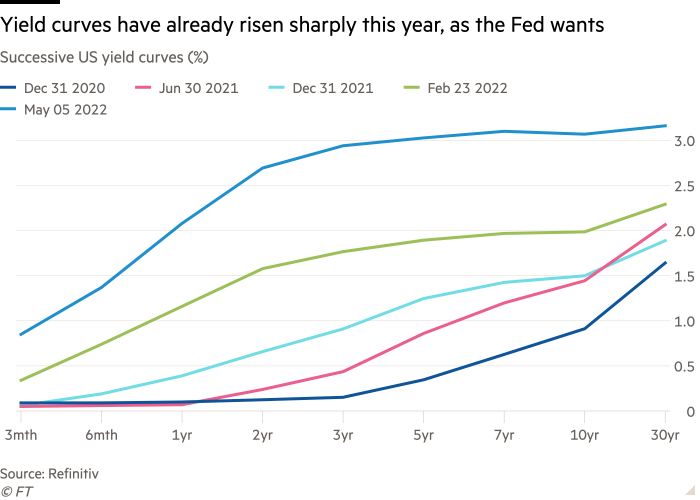

Another and probably more important uncertainty is over how tighter monetary policy affects financial conditions in the US and abroad. One must not forget that there are exceptionally high levels of dollar-denominated debt across the world. Moreover, asset prices have also reached extreme levels: US house prices (measured on the S&P/Case-Shiller National Home Price Index, deflated by the consumer price index) in February 2022 were 15 per cent higher than before the financial crisis; and the cyclically-adjusted price/earnings ratio on stocks was higher than in any period since 1881, except for the late 1990s and early 2000. Collapses in asset prices in response to monetary tightening would turbocharge Fed policy, but unpredictably. Even modest Fed action has had large impacts: expected interest rates have jumped and markets have hit turbulence. Is what we have seen the end of that upheaval or, as seems more likely, only its beginning?

Except for historians, it may be idle to ask how we got into this pickle. Obviously, it is partly due to unpredictable shocks. But policymakers have been too optimistic about inflation. They should have started to normalise a monetary policy introduced in an extraordinary crisis once the worst had passed. The Fed is removing the punch bowl too late.

It is, alas, quite likely that a recession will now be needed to keep inflationary expectations under control. Moreover, even if it turns out to be unnecessary, because inflation just fades away, a recession may still occur, simply because even a modestly tighter policy wreaks havoc in today’s fragile asset markets. But the Fed has to sustain its battered credibility on inflation. That is the heart of the central bank’s mandate. It must screw up its courage and do what it takes.

Follow Martin Wolf with myFT and on Twitter

"soft" - Google News

May 10, 2022 at 11:11PM

https://ift.tt/HMrnJvb

A soft landing in the US is possible but unlikely - Financial Times

"soft" - Google News

https://ift.tt/nJcqbwT

https://ift.tt/v5Cw3oE

Bagikan Berita Ini

0 Response to "A soft landing in the US is possible but unlikely - Financial Times"

Post a Comment