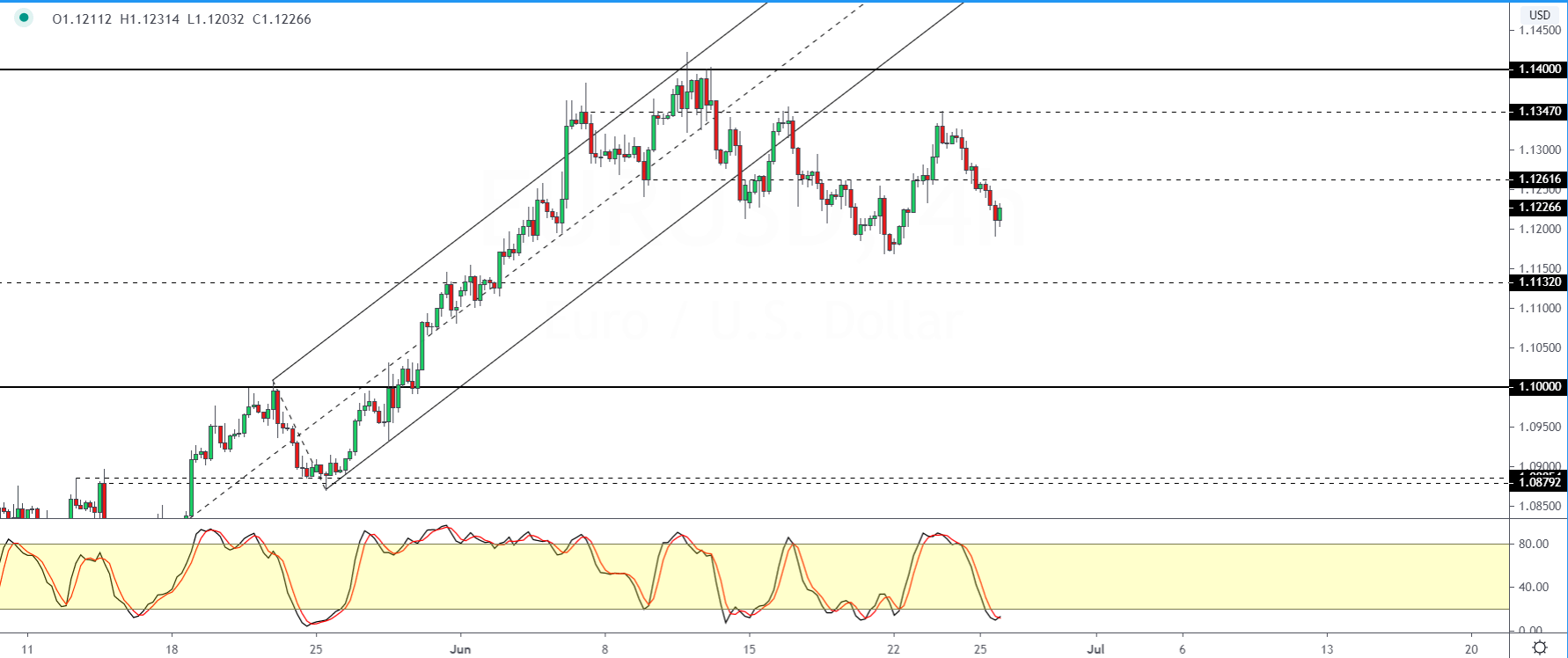

EUR/USD Turning Lower But Declines Look Limited

The euro currency is on track for posting two days of declines. However, price action remains somewhat resilient to the downside.

Following the decline into late Thursday, the common currency might be looking to rebound.

But the gains could be capped near the 1.1261 level where resistance might come in.

If price fails to breakout above 1.1261, then we expect a move lower, potentially to the 1.1132 level of support.

Ahead of the decline to this level, watch the minor support from the 19 June lows near 1.1172.

There is a possibility for a rebound off this price level as well.

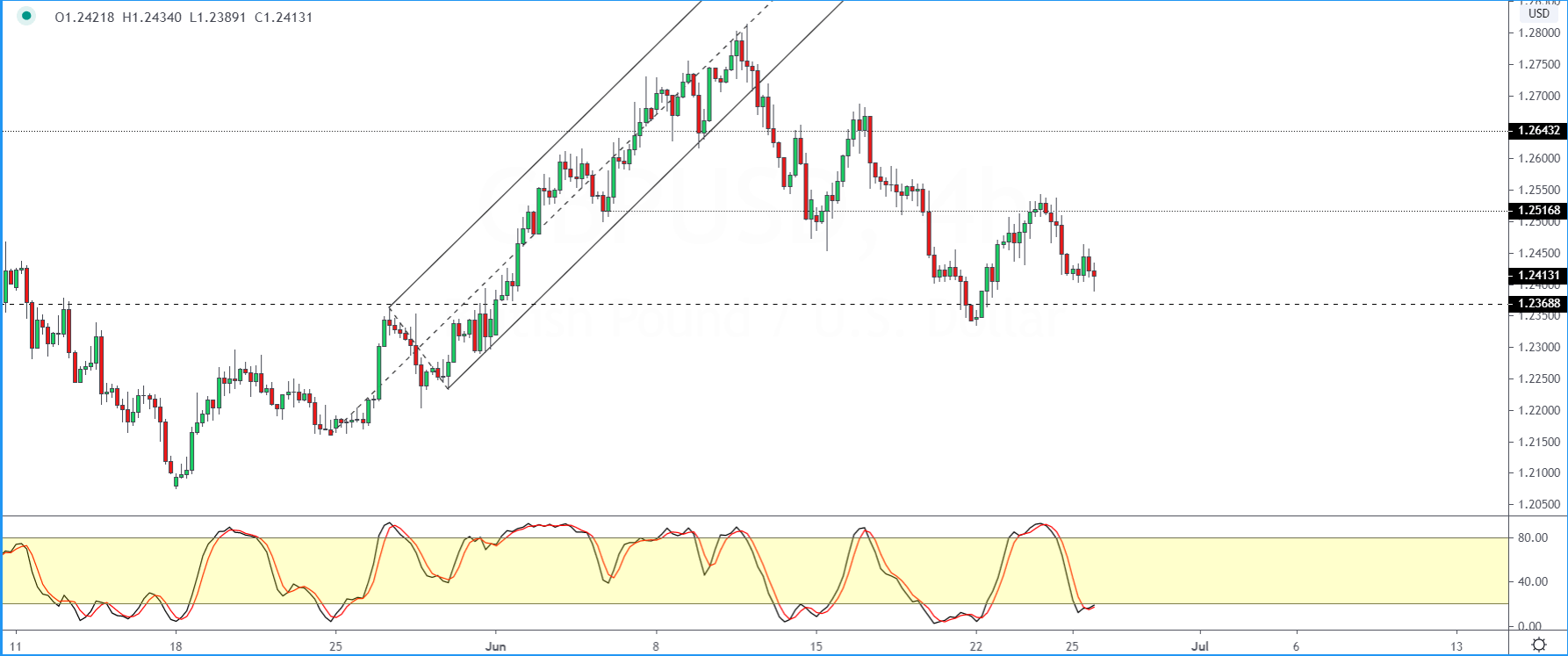

GBP/USD Holds In A Range

The British pound sterling's attempt to rebound was soft with prices now trading sideways intraday.

Overall, GBPUSD remains caught within the 1.2516 and 1.2368 levels. The bias is to the downside for a more firm test of the support area.

But there is a possibility for a higher low to form. This could set the stage for a breakout to the upside.

The Stochastics on the four-hour chart remains in the oversold level, which could suggest a short term move to the upside.

In any case, GBPUSD is poised to hold up if it retests the 1.2368 level of support again.

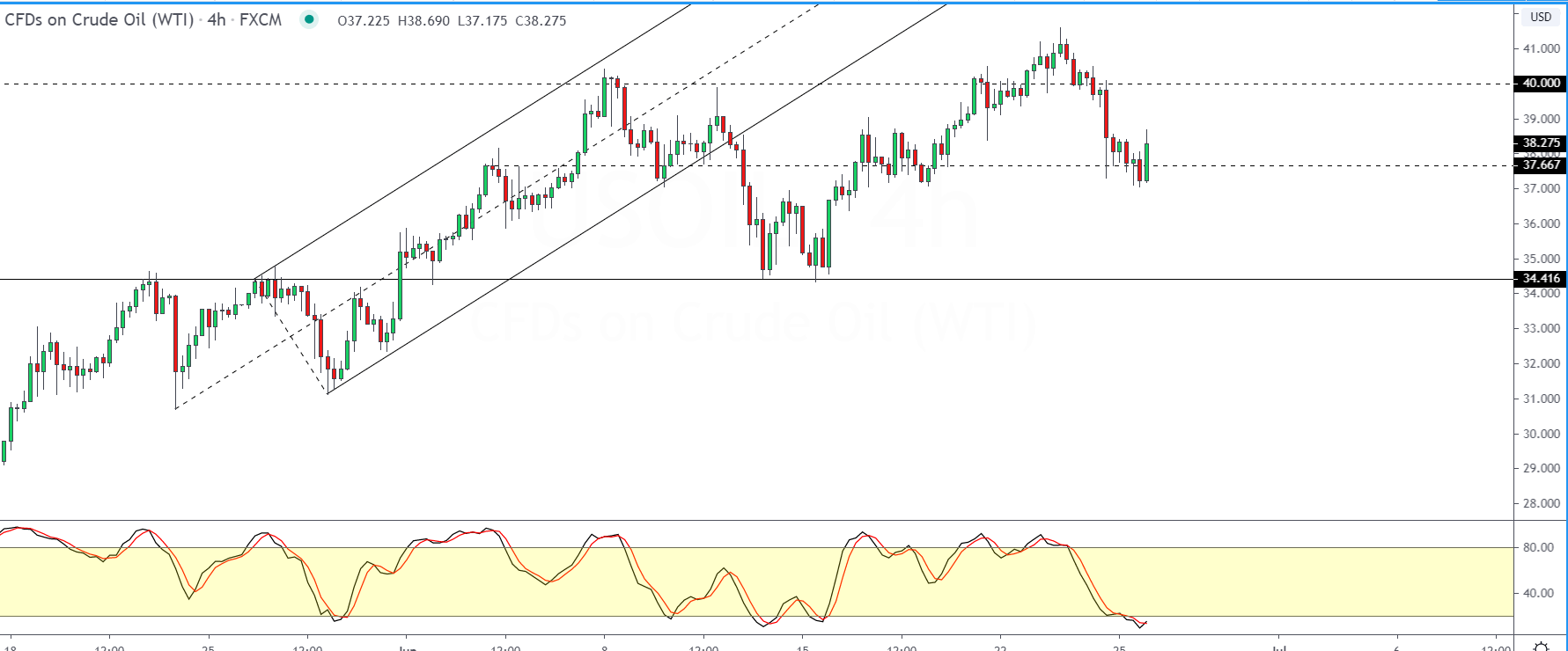

WTI Crude Oil Bounces Off Support

Oil prices fell to the support near 37.66 as expected. The rebound off this level is also seemingly holding up for the moment.

However, price action needs to close above this level to confirm that the support level is holding up for now.

In the near term, WTI crude oil might be stuck within the 40.00 and 37.66 levels.

This potentially raises the odds of a breakout that might emerge following the consolidation within the said levels. For now, the overall bias in crude oil remains to the upside.

Gold Takes A Breather After The Gains

Gold prices are trading rather muted on Thursday after the previous strong price action.

The precious metal touched highs of 1779 on Wednesday before retreating.

The breakout from the median line suggests a potential dip to the 1747 handle initially.

However, we could expect a larger correction to take place. This puts the downside target to 1732.

Given the recent consolidation that gold prices emerged out from, we could expect the upside to continue.

Watch for short term higher highs forming that might potentially confirm the bullish bias to resume.

"soft" - Google News

June 26, 2020 at 03:15PM

https://ift.tt/2CAASgb

USD trades soft after previous day's gains - FXStreet

"soft" - Google News

https://ift.tt/2QZtiPM

https://ift.tt/2KTtFc8

Bagikan Berita Ini

0 Response to "USD trades soft after previous day's gains - FXStreet"

Post a Comment