The U.S. labor market is weakening, just as the Federal Reserve wants.

Job growth is slowing, wage growth is slowing, and the number of hours workers are putting in is actually falling. With the inflation rate declining rapidly, it’s time for the Fed to step back and allow the economy to glide in for the soft landing that everyone wants.

Breaking...

The U.S. labor market is weakening, just as the Federal Reserve wants.

Job growth is slowing, wage growth is slowing, and the number of hours workers are putting in is actually falling. With the inflation rate declining rapidly, it’s time for the Fed to step back and allow the economy to glide in for the soft landing that everyone wants.

Breaking news: U.S. adds 223,000 jobs in December. Wage growth slows in sign of ebbing inflation pressures

Unfortunately, the Fed thinks it can’t do that. It can’t show any weakness. It feels trapped because its policy relies on perceptions of strength, not on actual victories on the battlefield of the economy.

Markets do the Fed’s job

The slowdown in the economy has largely been accomplished by the financial markets driving bond yields TMUBMUSD10Y higher and stock prices SPX DJIA lower. But if financial markets were to believe that the Fed is wavering, then stocks and bonds would rally and all the good work the Fed has accomplished in corralling inflation would be lost.

Looser financial conditions are a recipe for more inflation. Or so the thinking goes at the Marriner Eccles Building.

William Watts: Fed’s message to stock market: Big rallies will only prolong painful inflation fight

The Fed has expressed its fears that inflation could remain stubbornly high if wages were to rise rapidly. Those higher wages would fuel more demand for goods and services, and push prices higher, the Fed believes.

The good news in the jobs report

Those fears should be alleviated by the data released Friday.

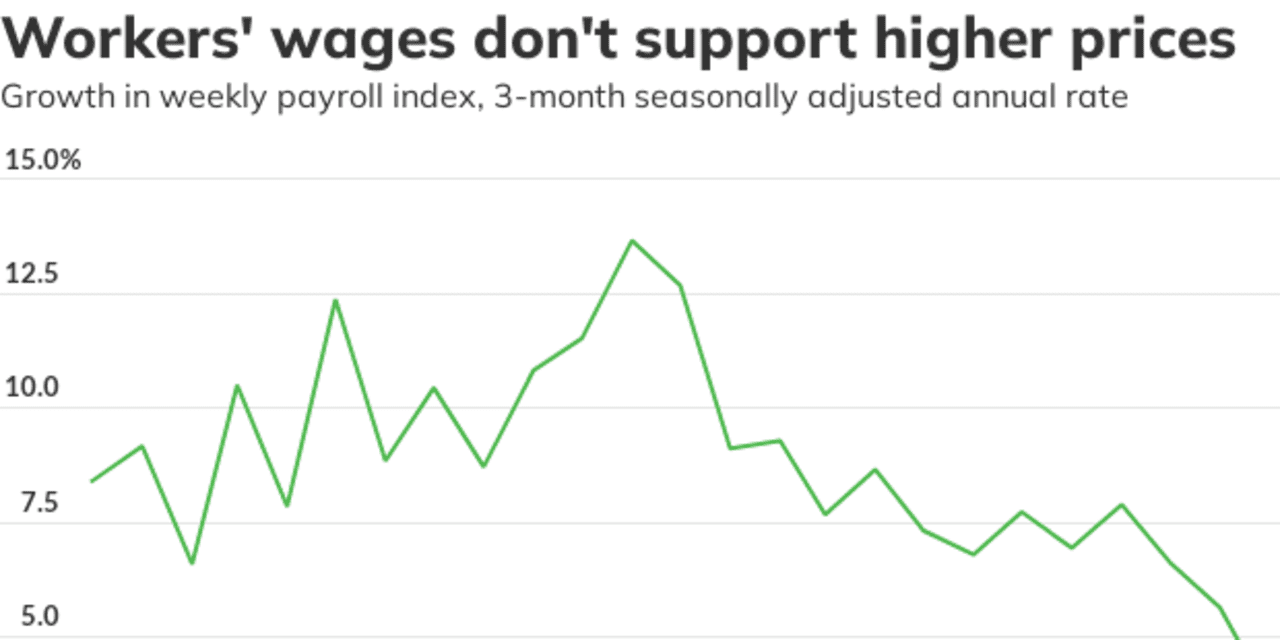

Average hourly wages rose 0.3% (or 3.5% annualized). Over the past three months, hourly wages have risen at a 4.1% annual rate, down from 5.9% at the beginning of 2022. If workers’ productivity increases at the usual percent or two, then that path of wage growth is not inflationary, or so the market believes.

While hourly wages are important, what counts for both working families and for the Fed is the weekly paycheck, which is determined by the hourly rate and by how many hours are worked. Lately, the average number of hours worked has dropped from 34.8 hours at the beginning of 2022 to just 34.3 hours, which is below the long-run average

In December, private-sector companies added 220,000 workers, but the total number of hours worked in the private sector fell at an annual rate of 1.1%, the second decline in a row. This is a key leading indicator of growth, because output depends in part on the total effort made by workers.

The total amount of wages paid to private-sector workers rose in December at an annual rate of 2.1%, about half the increase that was usual before the pandemic. Over the past three months, the total wage bill has increased at a 3.7% annual rate, down from 9.1% at the beginning of the year. From an inflation point of view, this may be the most revealing statistic in the jobs report.

Demand is not rising faster than supply

What do all these numbers mean? Simply put, the effective demand from working families is not rising faster than the supply of goods and services.

That means inflationary pressures from wages are receding, not growing. That means that the Fed has met — at least for now — its goal of preventing a wage-price spiral that would keep inflation unacceptably high.

Unfortunately, the Fed can’t publicly acknowledge what’s going on. It’s afraid that any admission of success will only encourage the stock market bulls. The Fed fears that exuberance on Wall Street would goose the economy too much and let inflation get out of control again.

The Fed is fighting the last war. In 2021, it got inflation wrong, thinking it was “transitory.” In 2023, it’s getting inflation wrong in the other direction, thinking inflation is permanent.

It isn’t.

When conditions change, smart policy makers have the wisdom to change their minds.

Rex Nutting is a columnist for MarketWatch who has been reporting and analyzing the economy for more than 25 years.

More on inflation

The Fed should pause its rate hikes now that inflation has slowed significantly. But it won’t.

Bigger paychecks are good news for America’s working families. Why does it freak out the Fed?

What NASA knows about soft landings that the Federal Reserve doesn’t

"soft" - Google News

January 06, 2023 at 11:53PM

https://ift.tt/34JP7iZ

Opinion: The jobs report shows that the soft landing is here if the Fed allows - MarketWatch

"soft" - Google News

https://ift.tt/LWKcOxN

https://ift.tt/3gRpnc8

Bagikan Berita Ini

0 Response to "Opinion: The jobs report shows that the soft landing is here if the Fed allows - MarketWatch"

Post a Comment