Rising economic optimism buoyed stock markets on both sides of the Atlantic on Friday, after eurozone inflation figures and US jobs data boosted hopes of a soft landing this year.

But economists warned that while a recent big fall in energy prices has bolstered prospects for 2023, underlying inflation would maintain pressure on central banks to raise interest rates further to keep price rises under control.

Philip Rush, founder of consultancy Heteronomics, said: “Inflation won’t be able to sustainably return to the target until this core problem is conquered.”

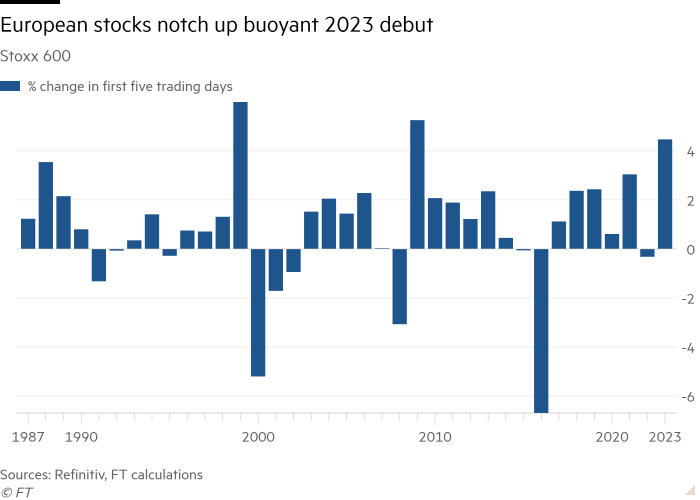

The headline eurozone inflation figures for December — which fell back into single digits — helped European equities to their best performance in the opening week of the year since 2009 as investors discarded some of their end-of-year gloom.

Goldman Sachs noted that lower wholesale natural gas prices, down over 75 per cent from their peak in Europe, would “boost real incomes; help to push down inflation; and improve government budgets”. It added a further export boost would come from the end of China’s zero-Covid policy.

In the US, the S&P was up almost 2 per cent in mid-afternoon trading after job growth slowed for the fifth consecutive month and hourly wages grew less than expected, providing some comfort against inflationary pressures. A survey showed that activity in the vast US services sector unexpectedly contracted in December, the first fall since the coronavirus crisis in May 2020.

But the US rate of job growth was faster than expected, at 223,000 for December, while the unemployment rate fell to an all-time low, giving little indication of a downturn in American economic performance that would bring inflation down quickly.

In both the eurozone and the US, the resilient economic data reinforced concerns that central banks will have to keep up efforts to bring inflation down to the low levels that preceded last year, despite clear indications that price rises have peaked. Central bankers worry that inflation may stay around 4-5 per cent rather than falling to its 2 per cent target on both sides of the Atlantic.

Dorothee Rouzet, economist at Citi, said the European data “now [point] to a very mild recession, bordering on no recession”. That, she added, would encourage hawks in central banks to be “concerned about wages and [profit] margins taking over [from energy] as inflation drivers”.

The fall in gas and petrol prices in the eurozone helped the region’s inflation descend to a lower than expected 9.2 per cent from 10.1 per cent.

The slide in energy prices also boosted the EU’s economic sentiment indicator, to only 4 per cent below its long run average.

But because prices of services and non-energy industrial goods rose faster in December, the region’s core inflation rate — which excludes energy and food prices — edged higher, reaching 5.2 per cent, the highest since the single currency was created in 1999.

The European Central Bank is expected to raise interest rates by another percentage point to 3 per cent across two meetings in February and March with a peak of around 3.5 per cent reached before the summer. The US Federal Reserve is expected to raise interest rates above 5 per cent and hold them there for an expended period until inflationary pressures abate in the US.

In indications that the US economy is still hotter than the Fed would prefer, the job gains figures of 223,000 for December outstripped economists’ expectation of a 200,000 increase.

The unemployment rate unexpectedly fell to a historic low of 3.5 per cent, according to official data. “This is still a very tight labour market,” said Veronica Clark, an economist at Citi. “For an economist, a low unemployment rate [is] future upside risks for wages.”

"soft" - Google News

January 07, 2023 at 01:59AM

https://ift.tt/jQPl8IY

Markets boosted by rising hopes of soft landing for US and eurozone economies - Financial Times

"soft" - Google News

https://ift.tt/LWKcOxN

https://ift.tt/3gRpnc8

Bagikan Berita Ini

0 Response to "Markets boosted by rising hopes of soft landing for US and eurozone economies - Financial Times"

Post a Comment