DNY59

Market observers are looking forward to a soft landing for the economy in 2024.

And a soft landing should lead to all-time highs for Wall Street next year, according to Seeking Alpha analyst and Investing Group leader Lawrence Fuller. But Fuller also suggests that, as a soft landing plays out, investors should be positioned to take advantage of any gains during the first half of the year. And they should put an emphasis on value over growth, he says.

In addition, Fuller predicts the Fed may take an approach with its interest rate decisions that's neither restrictive nor stimulative. The Fed may achieve its desired soft landing if inflation is tamed, along with positive economic growth.

Fuller shares his outlook below (please note, due to the timing of this series of articles, the Q&A took place Dec. 10):

Seeking Alpha: You're looking for a soft landing in 2024, a scenario that most market optimists are hoping to see. Does this compel investors to have more of a risk-on attitude as the year progresses? Or do investors become/remain more cautious, even with an improving economic environment?

Lawrence Fuller: One year ago, my outlook for 2023 was for a soft landing, so I don't need to make a lot of adjustments for 2024. At that time, most investors thought I was nuts. As the year has progressed, risk assets prices are gradually factoring in that outcome, and I think we are within six months of achieving it. That said, the market is a discounting mechanism, which means that by the time the soft landing is in plain view, most of the market gains will largely be behind us.

For this reason, I'm a lot more optimistic about the first half of this year when it comes to risk assets. My concerns grow in the second, depending on how quickly the Fed moves to normalize interest rate policy and head off the lagging impact of today's tighter financial conditions. Therefore, while I'm in risk-on mode now, I may become more defensive as the year progresses. If we face economic headwinds near the end of 2024 or in 2025, then market prices are likely to start reflecting that three to six months in advance.

SA: What are the specific signs that define a soft landing? The gradual decrease in inflation? Continued economic growth? A continual decline in long-term interest rates?

LF: A soft landing is defined as a gradual slowdown in the rate of economic growth that occurs when a central bank raises interest rates just enough to arrest inflation and slow an economy that could be overheating without causing a recession.

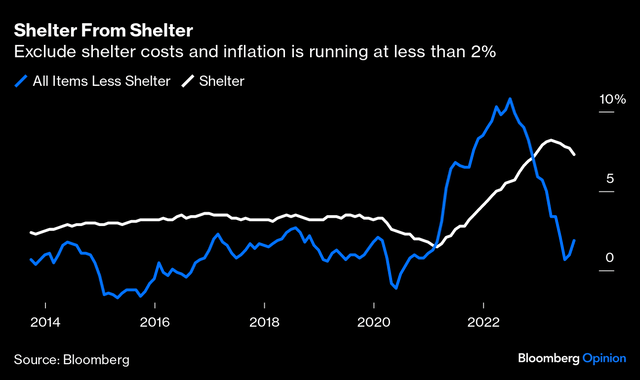

We have largely won the war on inflation. The latest Consumer Price Index report revealed that inflation excluding shelter costs is already running below 2%. We know the annualized increase in shelter costs, which operates with a lag, is scheduled to decline dramatically based on the most recent monthly numbers. This is half the equation.

Bloomberg

Whereas inflation was the primary concern in 2023, the focus is likely to shift to whether the economic expansion can sustain itself in 2024. I see the expansion continuing in 2024 for the same reasons I thought it would continue a year ago. Unlike previous expansions, this one was built from the bottom up. Post-pandemic relief efforts were focused on the working class, which realized the largest percentage gains in wealth and income. That allowed the consumer to weather the inflation storm in 2023 until we returned to real (inflation-adjusted) wage growth, which started a few months ago. Growth in real wages is critical to sustaining growth in real spending, which is what fuels our economy.

If the Fed can achieve its targeted inflation rate while also maintaining a positive rate of economic growth, then we will have our soft landing. I think we are on track for both in 2024.

SA: How aggressive could the Fed be in 2024? You've suggested that the Fed may be neither restrictive nor stimulative.

LF: In 2023, I advised investors to focus on what the Fed was most likely to do based on incoming economic data rather than what its officials espoused it may do in between its scheduled policy meetings throughout the year. The rhetoric was designed to manage inflation expectations, which were elevated in 2023, instead of providing policy guidance. That fueled investor concerns about a "higher for longer" policy stance and instigated the surge in interest rates and correction in the market from August through October. It was red meat for the bearish narrative that turned out to be a bear trap.

I suggested in October that the Fed would be forced to pivot from "higher for longer" to "lower and sooner," as incoming inflation data affirmed that the disinflationary trend was intact and that the Fed's target of 2% would be achieved well ahead of its projection. In fact, one of the Fed's most hawkish members did pivot soon after. Fed Governor Christopher Waller stated that if inflation were to fall for several more months, which is now the consensus view, the Fed could start lowering its policy rate. That led futures markets to start pricing in rate cuts as soon as March, and it undermined the prevailing wisdom that rates would stay high until the Fed broke something. In other words, a recession started. After the December FOMC meeting two weeks ago, the whole picture changed as the new dot plots signal there will be three rate cuts in 2024.

I think Chairman Powell wants to be as gradual in reducing the Fed funds rate as he was in increasing it, but far more timely, which means the Fed needs to start sooner rather than later. I think we will see a rate cut at every meeting that follows the first reduction, which ultimately takes us to what is called the "neutral rate," in that, it's neither stimulative nor restrictive. As recently as October, Fed President Mary Daly suggested that this rate falls between 2.5% and 3%, which makes sense to me. That equates to at least 225 basis points of rate cuts. That's probably too much to realize in 2024, but I think we will be below 4% by year-end.

SA: Any thoughts on how things progress with the employment picture?

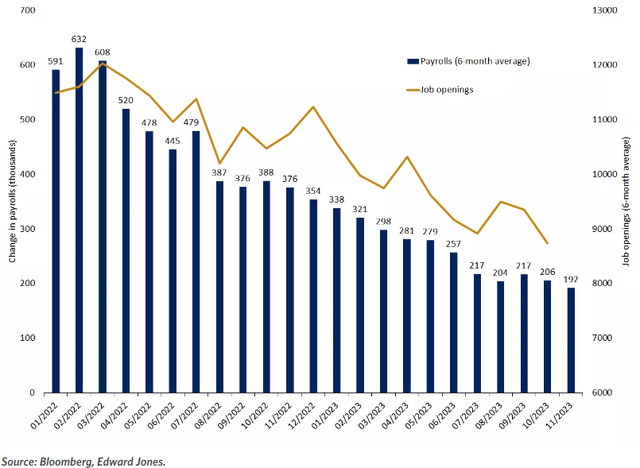

LF: We need approximately 100,000 jobs per month to absorb growth in the workforce, and I think we gradually soften to that level, as we have been throughout 2023. Fortunately, there's still an abundance of job openings at 8.7 million, which is more than the number of unemployed and above pre-pandemic levels. That should reduce the likelihood that we see job losses in 2024.

Edward Jones

Growth in wages is likely to continue declining, along with job openings, to a level closer to the pre-pandemic range of 3%-4%. Chairman Powell has said that wage growth of 3.5% is consistent with the Fed's inflation target of 2%.

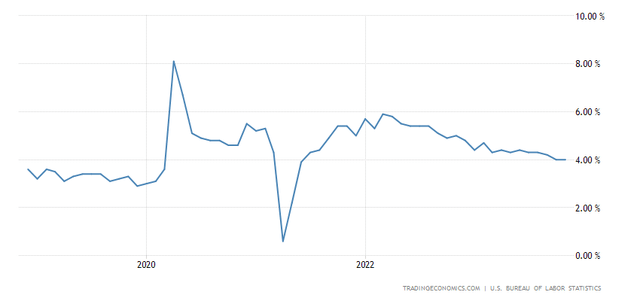

TradingEconomics

SA: If there's a soft landing, how high can markets go?

LF: I'm very confident with the positive market direction that started in November leading to much broader participation from index constituents in 2024. I think we are more likely to see that during the first half of the year than the second.

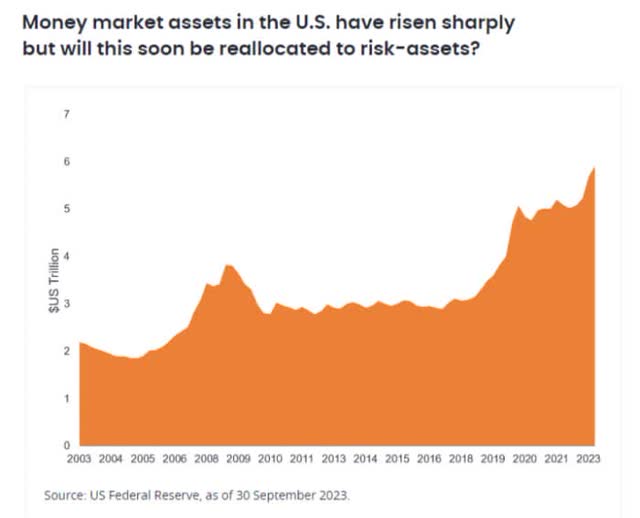

As far as how high the market can climb, a lot will depend on interest rates and investor sentiment as the year wears on. There's a mountain of liquidity in the form of $6 trillion sitting in money market funds that are now paying more than 5%. As the Fed starts to reduce short-term rates, the yield on this mountain will decline. As the yield falls below 5% and then 4%, investors are likely to reallocate to some combination of stocks and bonds. The mix depends on how attractive long-term rates are at that point and how optimistic investors are about the future. I can easily see the S&P 500 surpassing 5,000, which would be approximately 20 times the consensus estimate of $246 in earnings for the index.

Bloomberg

SA: How should investors position themselves for 2024? What are the opportunities? And the risks?

LF: The greatest risk in 2024 is that the Fed makes a policy mistake by keeping short-term rates too high for too long, resulting in a recession. I'm focusing on the year-over-year rates of real growth in retail sales and overall personal spending to decipher if that risk becomes a reality. If so, I think it would be a development for the second half of the year, as the lagged impacts of tighter monetary policy by a Fed that ends up being too reactionary have their full impact.

In that case, with respect to my bond allocation, I would extend the duration to capitalize on lower long-term interest rates, focus on higher-quality securities, and hedge a widening of spreads between Treasuries and lower-quality debt with select ETFs. In my stock allocation, I would overweight defensive sectors such as consumer staples, utilities, and healthcare with a focus on quality and sustainable dividend yields. I also may increase my international exposure in expectation of a weaker dollar, assuming that foreign markets were not suffering from similar circumstances. An elevated cash position also would be prudent.

Since my outlook is for a soft landing and continuation of the bull market, I think investors should be in wealth accumulation mode, as I recommended at the start of 2023. I'm employing a barbell strategy in my bond allocation, which emphasizes the higher yields offered on short-term Treasuries combined with the potential for capital appreciation at the long end in corporate debt and fixed-to-variable rate preferred issues should long-term rates continue to decline. This gives me the flexibility to reinvest money as short-term holdings mature and the uncertain interest-rate environment evolves.

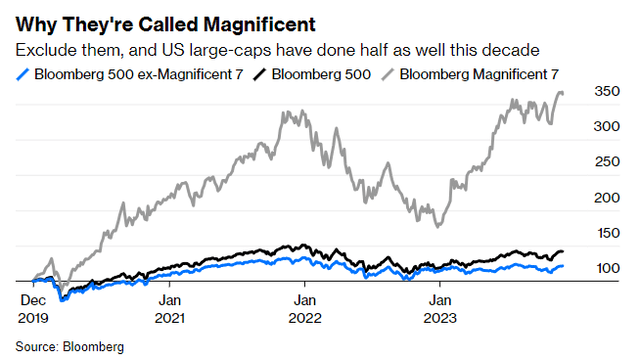

My stock allocation remains fully invested and well diversified across sectors but with an emphasis on value over growth. The outperformance of the Magnificent 7 is unlikely to continue at the pace it did in 2023, and we saw the beginnings of that in November and December.

Bloomberg

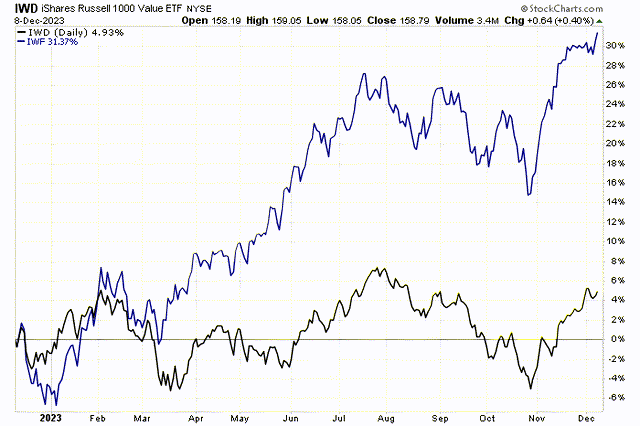

More important is the divergence between growth and value, which can be seen in the performance of the Russell 1000 growth and value indexes. Through the end of October, investors were worried about the Fed continuing to raise interest rates to fight inflation, which depressed value-oriented companies that are more sensitive to a deteriorating economy. That changed as the consensus of investors recognized that rate hikes were over and rate cuts were sooner than most thought. I expect the first rate cut at the March meeting, which should help narrow the performance gap between growth and value. Financials (XLF) and energy (XLE) are two sectors that I'm currently overweight.

Stockcharts

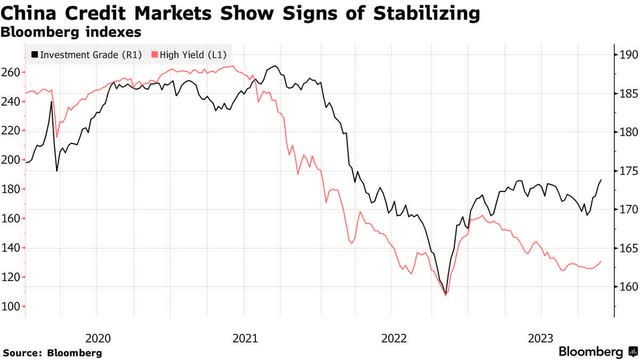

I'm also dipping my big toe into international markets (VWO) with a focus on the emerging ones. China (FXI) has suffered a lost decade for its stock market like the one we experienced from 2000 to 2009. The excessive pessimism has led to attractive valuations with the MSCI China Index trading at approximately 9 times forward earnings expectations. China's credit markets are improving, which typically lead equities, with the investment-grade bond market on track to post its first annual gain in three years. Government stimulus should follow for a market that seems to have very attractive risk vs. reward over a 12-month horizon.

Bloomberg

As always, I think it's important to remain tactical. We are bound to have another correction in the market in 2024, which will fuel the debate about another bear market, as it did in March and October of 2023. Making the right call about whether the next correction is a buying opportunity or the early stages of another bear market will be the key to success in 2024, as it was in 2023. There's no way to determine which at this stage of the game because there are always unforeseen macroeconomic and market developments that must be factored into the equation. That's what makes market strategy a 24/7/365 game.

"soft" - Google News

December 26, 2023 at 08:00PM

https://ift.tt/TKzp4Vk

2024 Analyst Outlook: Lawrence Fuller On An Economic Soft Landing Scenario - Seeking Alpha

"soft" - Google News

https://ift.tt/Ms7Q8Ui

https://ift.tt/fRYhwEI

Bagikan Berita Ini

0 Response to "2024 Analyst Outlook: Lawrence Fuller On An Economic Soft Landing Scenario - Seeking Alpha"

Post a Comment